Supply liquidity

Learn how to supply assets to a liquidity pool on Balanced.

You can supply assets to the Balanced exchange to increase the liquidity available for trades. Liquidity pools receive 50% of the trading fees, and if you supply liquidity to an incentivised pool, you’ll earn BALN daily.

Liquidity pools use the old Balanced tech stack, so they’re no longer supported in the main app. Liquidity providers stopped earning BALN incentives when governance and BALN inflation were halted in November 2025. You can continue to access liquidity pools via the legacy exchange.

Supply assets

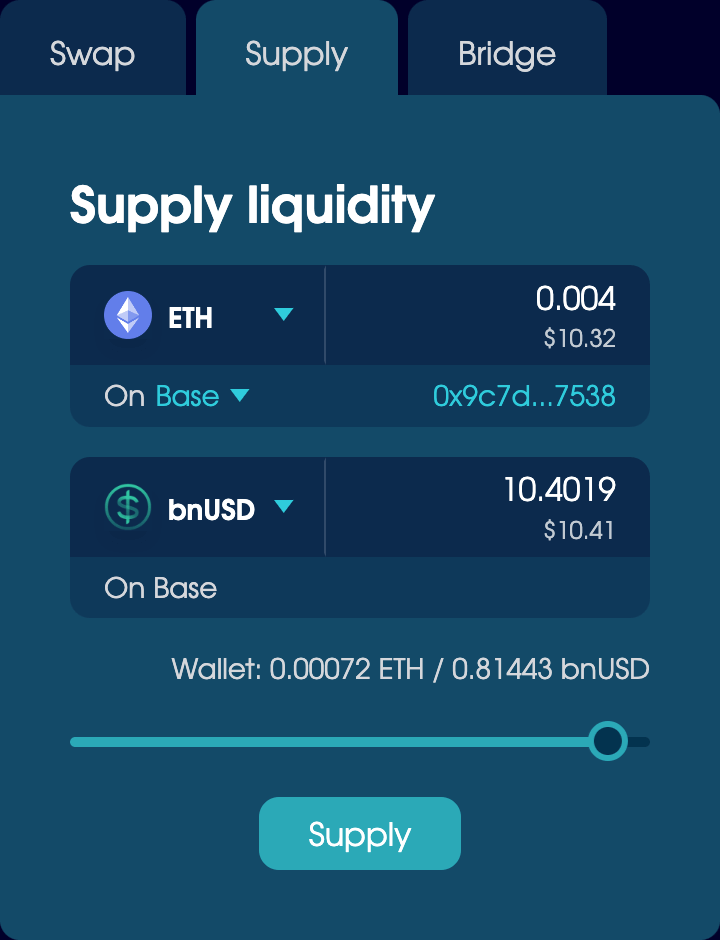

Go to the Supply tab on the legacy exchange, then:

- Choose an asset and the chain to supply on.

- Pair it with bnUSD or sICX.

- Enter an equal value of both assets, or create a new pool to set your own price ratio.

- Click Supply or ‘Create pool’, then follow the prompts to add your liquidity to the pool.

If you supply liquidity but don’t see it in the app, or you leave the page before the transaction is complete, try to supply a small amount to the same pool. The confirmation modal will include your assets, which you can then remove.

Stake LP Tokens

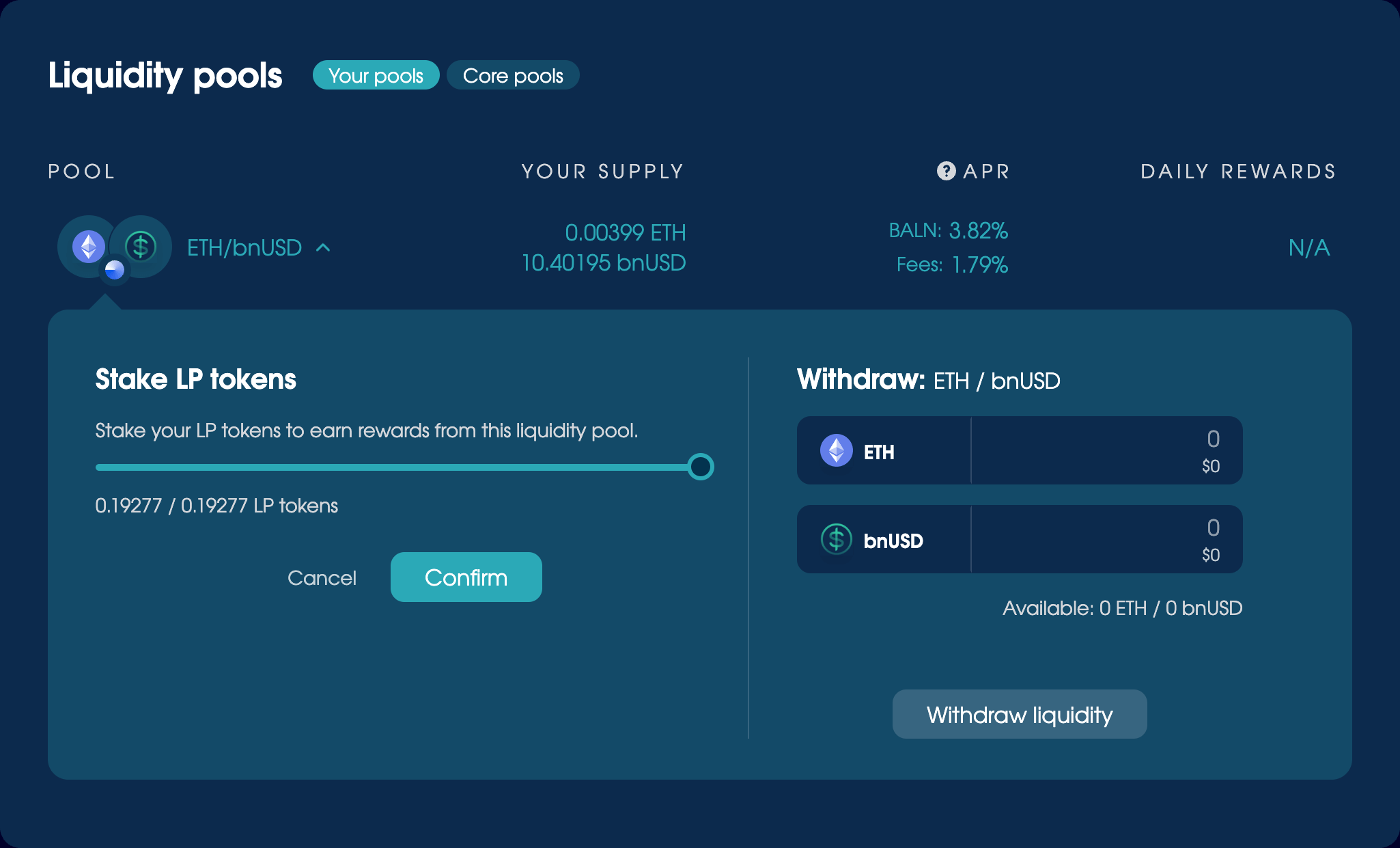

To earn rewards for incentivised pools, you need to stake LP Tokens (which represent your position in the pool):

- Click to expand the pool in the Liquidity Pools section.

- Click ‘Adjust stake’ and use the slider to set the amount.

- Confirm the transaction.

You’ll earn rewards until you unstake them, and can’t withdraw your liquidity until you do. You can claim rewards on the Home page, and lock up BALN to maximise your return for liquidity on ICON.

Withdraw liquidity

To withdraw liquidity, click to expand your pool in the Liquidity Pools section.

Unstake your LP Tokens if staked, then choose the amount to withdraw and complete the transaction.

If you don’t see your liquidity details for a third-party liquidity pool, make sure you haven’t staked your LP Tokens on another platform.